South Korea and Australia provide a cautionary tale of the limits of monetary policy when other factors also influence the outlook for residential property.

While her economic policies are not the answer, she would not damage US democracy, undermine Federal Reserve independence and sow chaos.

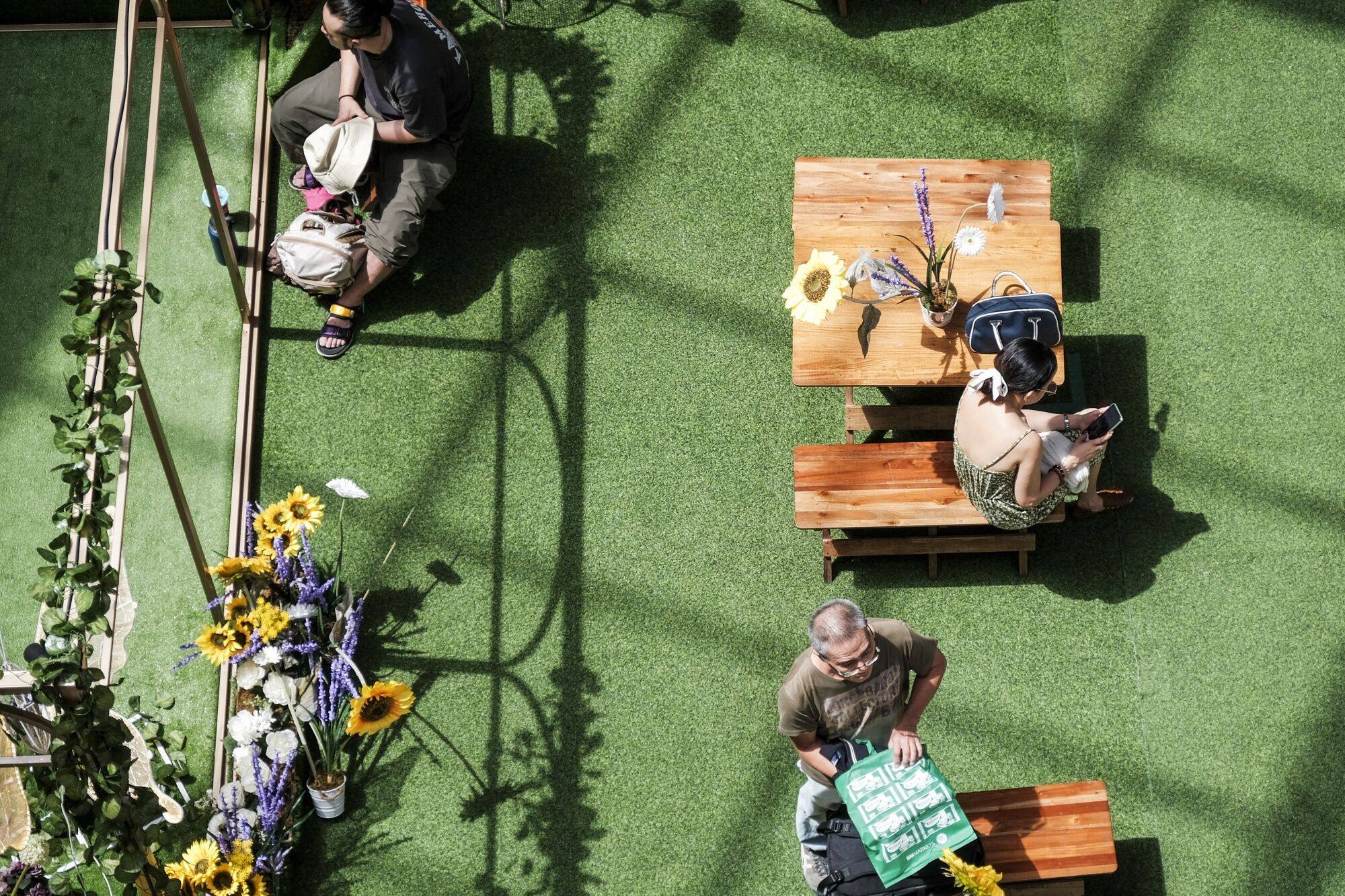

The shifts in rental markets such as Hong Kong, Singapore and Bangkok have shared themes which need to be put into proper perspective.

Concerns about the sovereign debt market shouldn’t be related to threats to financial stability but the risk of a more severe economic downturn.

Japan’s real estate industry is not immune to the fallout from ending ultra-loose policy, but its market’s appeal must not be underestimated.

The US is not the only source of volatility in the global economy, but the size of its economy and capital markets make it the most worrying.

Evidence points to a slowdown in Singapore’s residential property market, but a normalisation of activity is being misconstrued as a crisis.

While Donald Trump returning as president poses political risks, the US dollar is more insulated against his policies than many might think.

Hong Kong’s real estate sector has endured a series of shocks, yet it is far more resilient than dire reports of its state might suggest.

China’s trade surplus and deflationary policies propping up its push for hi-tech manufacturing mean a sharp US response is likely, whoever wins the November election.

The advantages that carried Asia’s office market through the Covid-19 pandemic are weakening amid a supply boom and shifting priorities.

While investors appear sure of a Trump victory, they have yet to come to terms with the far-reaching consequences of Trump’s re-election.

Unlike in Japan, Australia’s restrictive planning rules and housing policy constrain the market’s ability to respond to rising demand.

The political chaos and the sway of populist politicians in the US and France are no reason to overlook the many problems facing Britain.

While many investors would love to gain exposure to Asia’s data centre sector, few are willing or able to deal with its associated risks.

US and European politics are entering a new and much more dangerous phase that has major consequences for the global economy and markets.

Rental growth is a cause for concern in Asia’s residential property market, but it is also a key driver of returns in the commercial sector.

Rather than hugging a broad index or betting on a certain country, investors must be discerning and focus on themes and trends in each country.

The yuan is under strain from internal and external pressures, making the balancing act that China’s monetary policymakers are trying to manage even trickier.

Investors overlook the Philippines, but Southeast Asia’s fastest-growing economy is attractive, affordable and has more potential to unlock.

Political shocks during this year’s plethora of elections have roiled markets, but no source of political risk is greater than Donald Trump.

Hongkongers flocking to the mainland, a strong Hong Kong dollar and sharper competition weigh heavily on local retailers’ fortunes.

With policy continuity likely, strong fundamentals intact and pressure on the government to create jobs, investors’ optimism looks justified.

Australia’s migration-fuelled population growth has been a driving force behind increasing demand in the property sector. However, while immigration is being blamed for the housing crisis, the problem is linked more to limited supply, planning laws and the tax system

It is easy to be pessimistic about the world and the global economy, yet stock markets have hit record highs. Borrowing costs are coming down, growth is stronger than expected, tech stocks are thriving and investors are taking a glass-half-full approach.

Beijing’s forceful measures to stem the crisis in the housing market have contributed significantly to the improvement in sentiment around Chinese stocks. The recovery remains vulnerable without meaningful improvement in confidence in the housing market, but investors have reason to hope.

Despite lingering memories of the chaos and protectionism of Trump’s presidency, financial markets show little concern about him possibly returning to office. Investors who downplay the risks of Trump’s re-election ignore the threat he poses to democracy, the global trading system and the independence of the Federal Reserve.

Prices in Singapore’s public housing system are under growing scrutiny as million-dollar sales make headlines and raise fears over affordability. Those sales are outliers, though, amid the government’s efforts to keep speculative demand to a minimum.

Many investors believe the current rally in Chinese stocks is built on shaky foundations, but there are reasons to think this surge could last. Data beating expectations indicates a stabilising economy, markets seem convinced by Beijing’s policy moves and the rally not disconnected from domestic fundamentals.

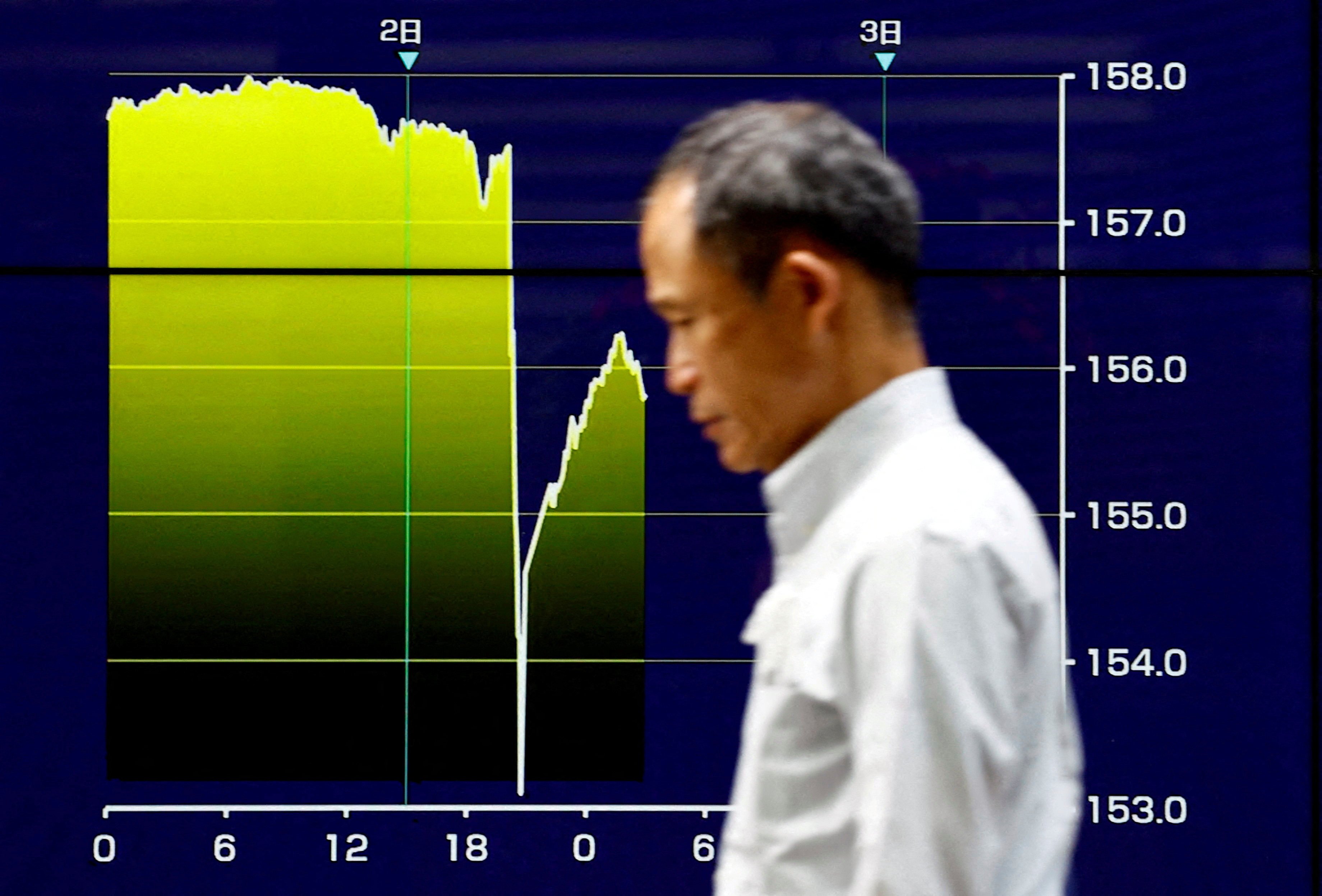

The prospect of ‘higher for longer’ interest rates and a ‘stronger for longer’ US dollar has hit Asian markets particularly hard, with Japan an extreme example. The only way the dollar will fall meaningfully is if the US economy slows sharply and the Fed cuts rates sooner and at a faster pace than markets expect.